Prior to the financial collapse of 2008, obtaining capital was binary. You either qualified for it or you didn’t. Extension of credit came from places like banks, and that credit was based on the same factors a bank uses today: credit score, length of time in business, profitability and cash flow coverage. If you didn’t meet the criteria, that was it: no cash for you. But since the recession, things have  changed. Like most recessions, new technologies and innovation emerged as a by-product of survival. After the recession, advertising technology evolved tremendously, creating a new digital media economy. And like a traditional economy, liquidity is needed to grow, survive and thrive, the that’s the role we’re filling: financing for digital media and the new economy.

changed. Like most recessions, new technologies and innovation emerged as a by-product of survival. After the recession, advertising technology evolved tremendously, creating a new digital media economy. And like a traditional economy, liquidity is needed to grow, survive and thrive, the that’s the role we’re filling: financing for digital media and the new economy.

What is Digital Media Financing?

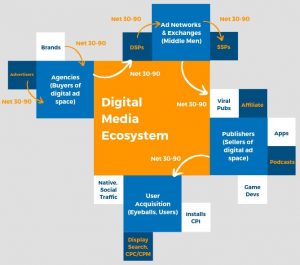

Digital media financing is an invoice funding solution for businesses that earn revenue from serving digital ads, like web publishers, smart phone apps, ad exchanges, media buyers and ad agencies.

How does Financing for Digital Media work?

There are two ways a business can financing their digital media: by selling or “factoring” their invoices, or by using their invoices as collateral for a loan. But first, what are digital media receivables?

In our article, Digital Media Receivables Financing, we defined digital media receivables as invoices that are created from advertising revenue. In other words, a business – like an ad exchange – gets paid for serving a digital ad, but they have to wait 30-90 days to get paid. After they serve the ad, they issue an invoice to get paid in X number of days. They would be the holder of a “digital media receivable”, and there are two ways digital media financing works:

- Digital Media Factoring – this is when a business sells their invoices outright for 80-90% upfront to OAREX. OAREX then collects directly from the company that is paying the invoices. After OAREX gets paid, we remit the 10-20% to you, minus our fees. The benefits of this financing is that it’s risk free to the seller of the invoice (i.e. OAREX clients), because OAREX takes collection risk. There are no personal guarantees, no covenants like a bank would require, etc. Just a simple purchase and sale.

- Digital Media Financing – this differs from factoring in that a loan is made the client against the entire basket of invoices. In the event of non-payment however, you remain liable to OAREX.

Which one should I choose?

If you want a risk-free solution, digital media factoring is better for you. It will be slightly more expensive but will give you the freedom and peace of mind to scale your business without the worry of non-payment. However to qualify, your customers must be approved for credit.